FINANCIAL IMPACT

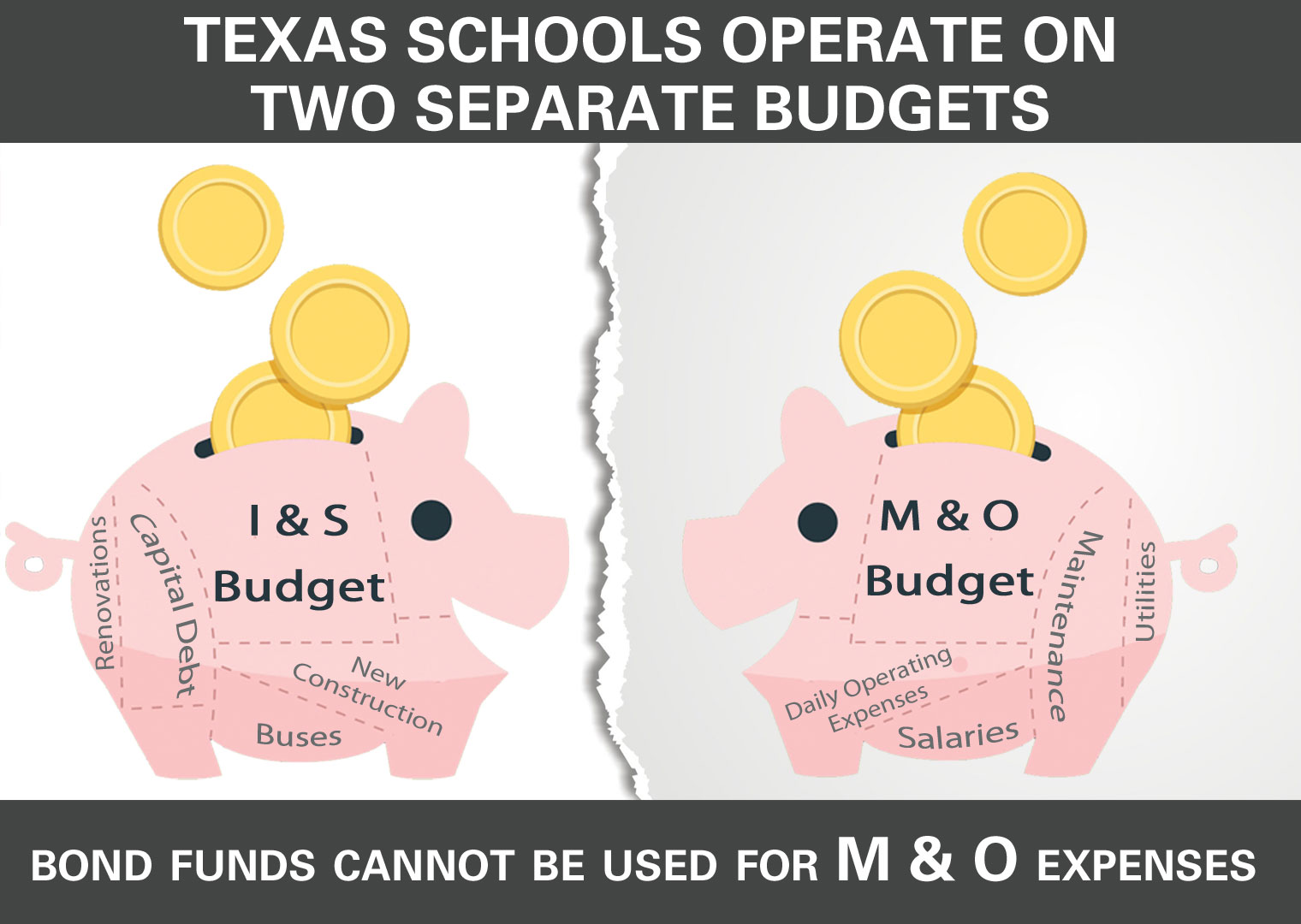

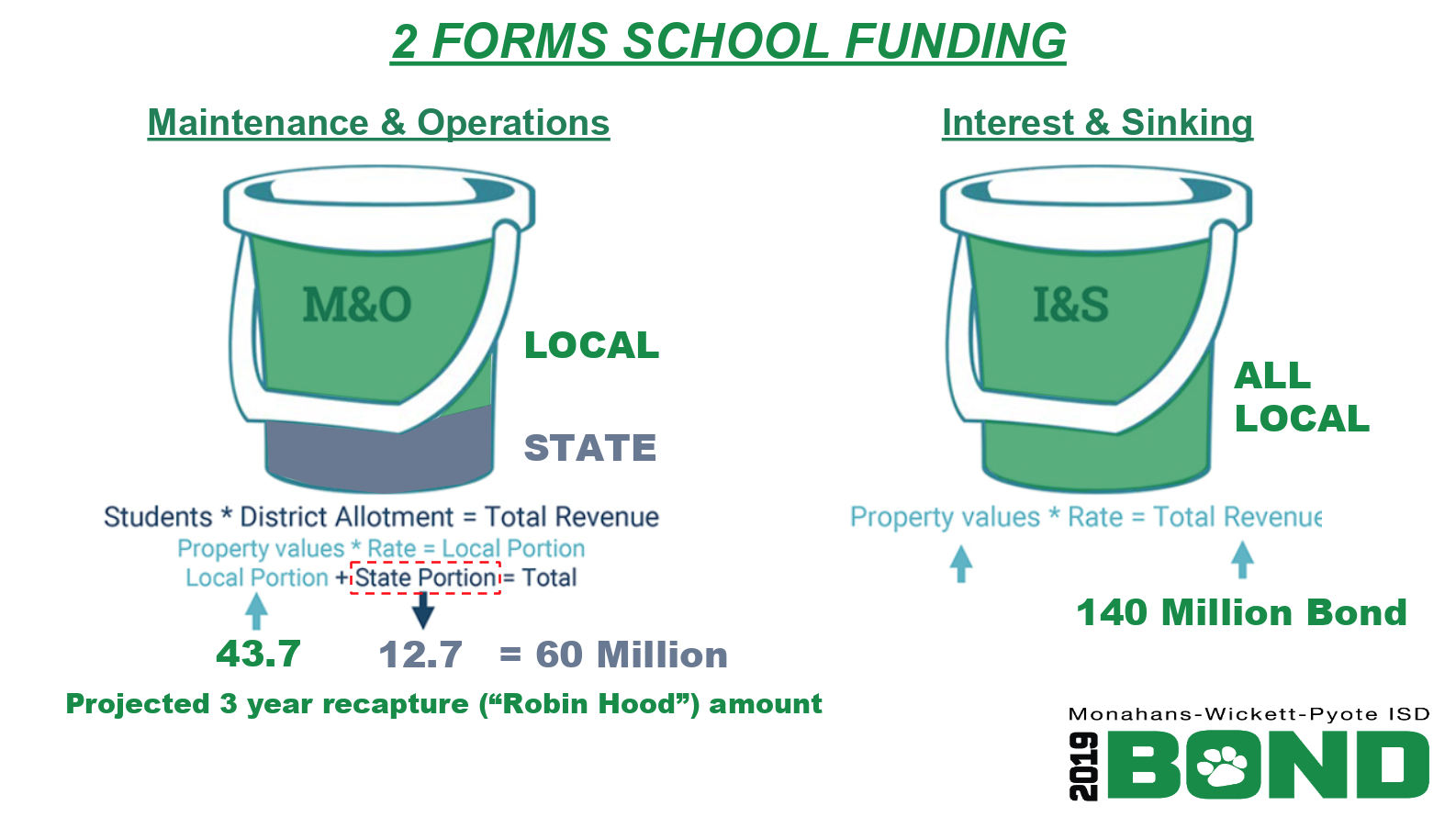

Public schools in Texas operate on two separate budgets:

- Maintenance & Operations (M&O), used for daily operations such as utilities and teachers’ salaries.

- Interest& Sinking (I&S), which pays for capital debt, new construction, and renovations.

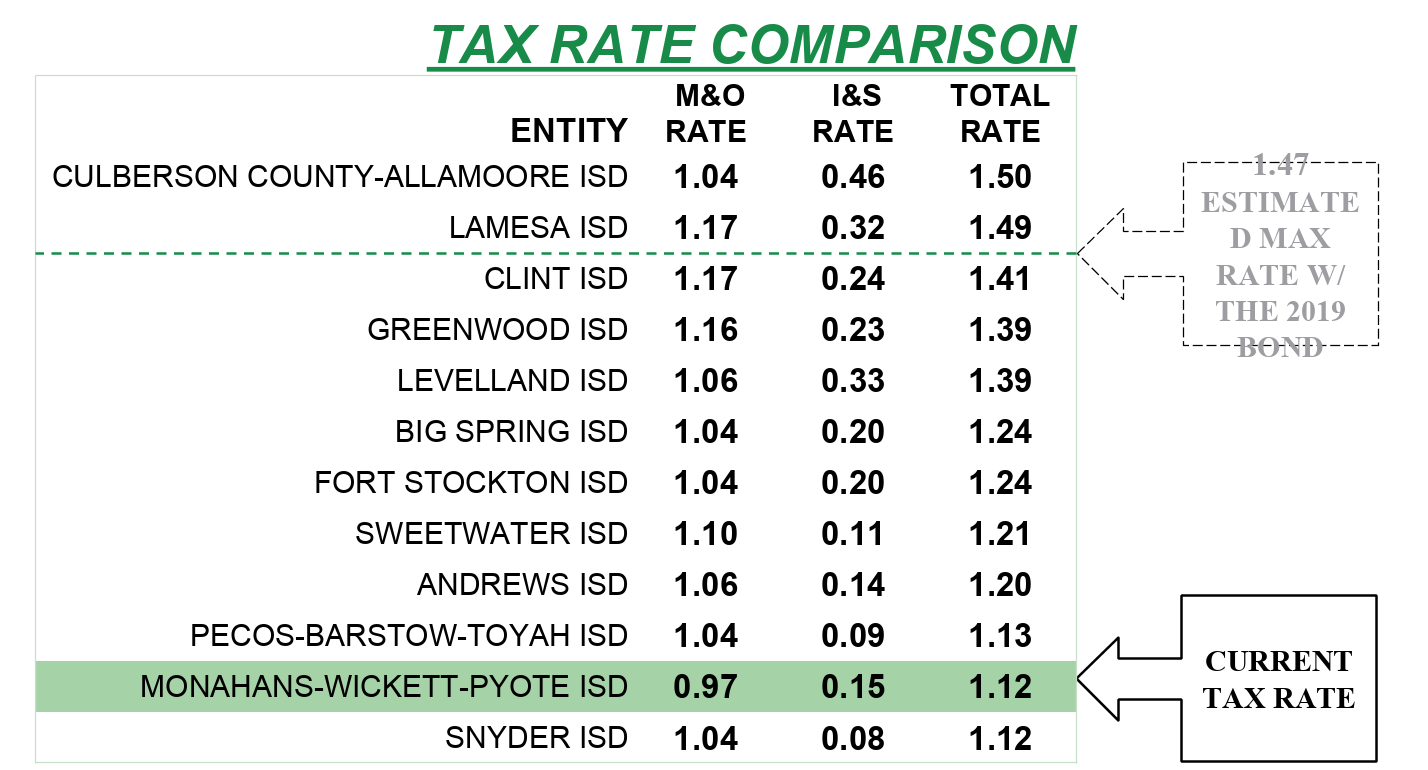

In order to fund the I&S budget, our schools rely on the support of local tax payers to finance the design, construction, expansion and renovation of facilities.