What is a Bond and why do we have an election?

A bond is similar to a home mortgage. It is a contract to repay borrowed money with interest over time. Bonds are sold by a school district to competing lenders to raise funds to pay for the costs of construction, renovations and equipment. Most school districts in Texas utilize bonds to finance renovations, new facilities, and the purchase of technology and buses. State and Federal funding does not cover these costs.

Why is Monahans-Wickett-Pyote ISD calling for a bond election?

The Board of Trustees unanimously approved to call for a $140 million bond referendum based upon the recommendations of the 22-member Community Focused Committee, which spent five months studying current and future district needs and prioritizing their findings as follows:

- Safety and security of students and staff

- Potential growth due to economic dynamics

- Modernization of classroom space

- Aging facilities

What is the total amount of the proposed bond package?

The total amount of the proposed bond package is $140 million. The proposal will benefit every student, campus and department served in the Monahans-Wickett-Pyote ISD and will address the prioritized list of needs established by the Community Focused Committee.

How did Monahans-Wickett-Pyote ISD determine the bond projects?

In 2015, the District engaged Parkhill Smith & Cooper to perform an extensive assessment of all of the district’s facilities. This assessment included 5-year and 6 to 20-year cost projections to address safety and security, educational adequacy, growth and capital renewal.

In September 2018, the Community Focused Committee, a 21-member group of concerned citizens, was formed to address the needs of the district and study the possibility of calling for a bond to address these needs. This committee was presented the 2015 Facilities Assessment and discovered that in order to simply upgrade district facilities to current educational standards the cost would be $79.2 million. However, this amount would not address future needs/concerns. The committee was focused on providing district facilities which would meet the needs of today’s learners, as well as those being served over the next 40-50 years.

After five months of concentrated work, the Community Focused Committee presented a final proposal to the Monahans-Wickett-Pyote ISD Board of Trustees which best met the group’s desire to address future generations of students and their prioritized list of the following needs:

- Safety and security of students and staff

- Potential growth due to economic dynamics

- Modernization of classroom space

- Aging facilities

Based upon this proposal, the MWPISD Board of Trustees unanimously called for a bond election during their regular meeting of January 21, 2019.

What is in the bond package?

The proposed bond package includes projects that address the Community Focused Committee’s prioritized findings. Proposed renovations and upgrades include districtwide improvements in the following areas:

- Safety & Security upgrades at every school

- Monanhans High School Transformation

- Career & Technology Expansion

- Walker Junior High Renovations

- New Elementary School & Upgrades at Cullender and Tatom

- Technology & Modern Learning Environments

What is included in Safety & Security?

- Districtwide safety and security upgrades at every school and every facility

- Secure entryways, secure access card-reader systems, electronic locking classroom doors, and centralized lockdown systems, connecting buildings to eliminate outside hallways

- Updated fire alarms, sound/public address systems, interior/exterior lighting, surveillance cameras, increased handicap accessibility, and additional parking lots and bus lanes

What is included in the High School Transformation?

- Replaces or remodels every building over 50 years old and past its useful life with modern learning spaces and safety & security upgrades

- Everything under one roof eliminating multiple entrances and outside hallways

- Capacity of 700 with space for future additions

- New computer labs, library, cafeteria, and kitchen

- New flooring, ceilings, exterior doors, energy-efficient windows, and parking lot asphalt

- Competition gym, practice gym, natatorium, baseball field, softball field, track, band marching pad

SPECIAL EDUCATION

- Add secure entry, electronic locking classroom doors, video cameras and other safety upgrades

- Remodel restroom and kitchen flooring, sidewalks, cabinets and update staff restrooms

TESTING CENTER

- Remodel of Monahans Education Center to a Testing Center with four large computer labs and a multipurpose conference room

- Add secure entry, electronic locking classroom doors, video cameras and other safety upgrades

FINE ARTS REMODEL

- New auditorium with 700 seats and Band Hall renovation

- New black box theatre, dressing rooms, and scene shop storage

- New Fine Arts addition, Choir addition, new art room, band hallway enclosure

ATHLETIC UPGRADES

- New competition gym with seating for 700 includes two new boys’ locker rooms and two new girls’ locker rooms

- Upgraded Sports Complex

- New 500 seat Natatorium with 8 competitive swim lanes

- Bell Field: new concession/restroom/ticket building and new locker rooms

- Estes Field: new West side home field house, press box, concession and restrooms

- Tennis: 8 new courts with covered seating, new boys’ and girls’ locker rooms

- New Junior High Football Field House with home and visitor locker rooms

When was the last bond election?

Citizens of the Monahans-Wickett-Pyote ISD approved a $30 million bond in 2006, 13 years ago, to address the district’s academic facilities. The current I&S rate needed to meet the required 2006 bond payments is $0.14. This bond will be paid off in 2026.

Due to the district’s strong fiscal management, several construction and renovation projects in Monahans-Wickett-Pyote ISD have been paid for out of Fund Balance or by private donations, including:

- 14 New Classrooms (4 at Cullender; 4 at Tatom; 6 at Sudderth) – Fund Balance

- Employee Housing Development – Fund Balance

- Indoor Golf Facility – Fund Balance & Private Donations

- Softball Field Updates – Fund Balance

- MHS Auditorium Lighting – Fund Balance

- Tennis Courts Lighting – Fund Balance

How soon will construction projects begin if voters approve the bond proposal on May 4, 2019?

The bonds may be sold anywhere from 45-60 days after the bond election. Generally, once a bond issue passes, the architects begin the design work and the bid process. Construction itself will begin several months after the election.

What is the financial impact of the proposed bond package?

If voters approve the bond election, the estimated tax impact of this bond is anticipated to be $0.36 for a total tax rate of $1.47 – M&O tax rate of $0.97 + I&S tax rate of $0.50. For the average MWPISD home valued at approximately $100,000, this represents an increase of $22.00 per month.

What can bond money NOT be used for?

Bond proceeds cannot be used for employee salaries, raises, recurring bills, utility expenses, maintenance costs, rentals, or other operating costs.

How are new facilities and facility improvements funded?

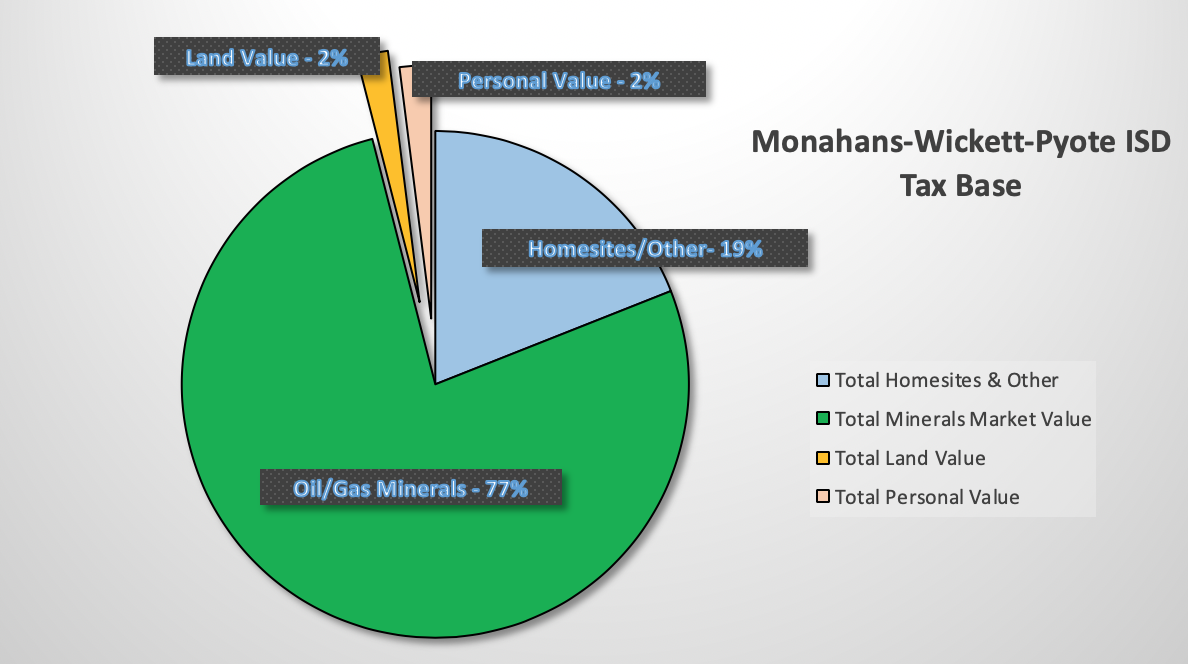

Funding for Texas’s public schools comes from three main sources: local property taxes, state funds, and federal funds. The majority of funding for Monahans-Wickett-Pyote ISD comes from local property taxes.

A school district’s property tax rate is comprised of a Maintenance and Operations (M&O) tax rate and an Interest & Sinking (I&S) tax rate. As its name suggests, the M&O tax rate provides funds for the daily operational costs of a school district. The I&S tax rate provides funds for payments on the voter approved debt that finances a district’s facilities. The current total tax rate for Monahans-Wickett-Pyote ISD is $1.12.

The district’s current M&O tax rate is $0.97 and cannot, in the future, exceed $1.04 without a tax ratification election. The revenue generated from this tax rate pays for salaries, utilities, furniture, supplies, food, gasoline, etc. For the average citizen, this is similar to house repairs, car fuel, groceries, cleaning supplies, utilities, etc. However, a school district is a people-intensive business and the largest portion of these funds are budgeted for personnel costs.

The district’s current I&S tax rate is $0.14 and is often called the debt service tax rate. Funds generated from this tax rate go toward paying off the debt generated by the issuance of school bonds. For the average citizen, this is similar to a new home purchase, home renovations, land purchase, new kitchen appliances, etc. School bonds are issued as funds are needed for approved school projects and are generally not issued all at once. Most school bonds are issued or paid for over 25 years. However, the repayment period for short term assets, such as technology items, are paid off much more quickly.

What is the impact on my finances if I am over 65 years old?

The State Property Tax Code allows for school property taxes on an individual homestead to be “frozen” at the age of 65. If you are 65 years of age or older and you have filed for the “Over 65 Homestead Exemption”, there is a ceiling on the amount of school taxes to be paid. The only exception occurs when improvements are made to a home. As such, a tax increase from a new bond program cannot increase the applicable tax ceiling of a taxpayer that has qualified for the “Over 65 Homestead Exemption.”

Can I still register to vote in the election?

The deadline for voter registration is April 4th. If you are not registered to vote by this deadline, then you are not eligible to vote in this election.

How does recapture, commonly referred to as “Robin Hood,” affect the District's Maintenance & Operations (M&O) Budget?

The recapture rate for Monahans-Wickett-Pyote ISD during the years of 2005-2018 averaged 14.27% of the total maintenance and operation budget indicating that for every $100 of taxable value the district was required to send $14.27 back to the state. During these years, MWPISD paid $30,336,598 in Chapter 41 recapture payments. The largest percentage of Chapter 41 recapture occurred during the 2015-16 school year when the district collected $27,532,207 of taxable value but returned $7,565,407 back to the state of Texas – a 27.48% recapture payment.

With the increase in the current oil/gas economy, it is projected that Monahans-Wickett-Pyote ISD will make the following recapture payments to the state for the next three years:

2019-2020: $3,297,438 16.01% of the collected taxable revenue

2020-2021: $4,206,975 19.30% of the collected taxable revenue

2021-2022: $5,162,393 22.95% of the collected taxable revenue

These projections indicate that for every $100 of ad valorem tax revenue collected the district will have to return $19.39 back to the state as part of the Chapter 41 recapture funding plan. Although the district will collect $60 million in taxes over these three years; due to Chapter 41, the “Robin Hood” plan, the state of Texas will recapture $12.7 million from the district.

How are new facilities and facility improvements funded?

Funding for Texas’s public schools comes from three main sources: local property taxes, state funds, and federal funds. The majority of funding for Monahans-Wickett-Pyote ISD comes from local property taxes.

A school district’s property tax rate is comprised of a Maintenance and Operations (M&O) tax rate and an Interest & Sinking (I&S) tax rate. As its name suggests, the M&O tax rate provides funds for the daily operational costs of a school district. The I&S tax rate provides funds for payments on the voter approved debt that finances a district’s facilities. The current total tax rate for Monahans-Wickett-Pyote ISD is $1.12.

The district’s current M&O tax rate is $0.97 and cannot, in the future, exceed $1.04 without a tax ratification election. The revenue generated from this tax rate pays for salaries, utilities, furniture, supplies, food, gasoline, etc. For the average citizen, this is similar to house repairs, car fuel, groceries, cleaning supplies, utilities, etc. However, a school district is a people-intensive business and the largest portion of these funds are budgeted for personnel costs.

The district’s current I&S tax rate is $0.14 and is often called the debt service tax rate. Funds generated from this tax rate go toward paying off the debt generated by the issuance of school bonds. For the average citizen, this is similar to a new home purchase, home renovations, land purchase, new kitchen appliances, etc. School bonds are issued as funds are needed for approved school projects and are generally not issued all at once. Most school bonds are issued or paid for over 25 years. However, the repayment period for short term assets, such as technology items, are paid off much more quickly.

When does early voting begin?

Early voting runs from October 22-November 2. All eligible voters in Randall County can vote at any designated early voting site. Find your location here.